FinCENs Final Signal to the Anti-Currency Laundering to possess Residential Home Transmits Queen & Spalding

Posts

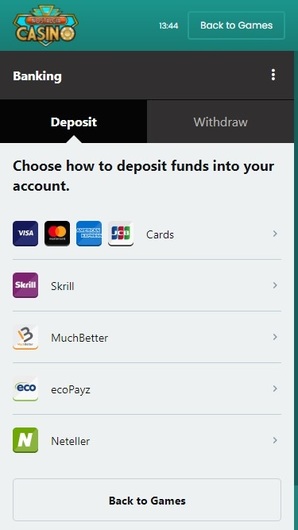

Typical debt obligations (age.grams., promissory cards and you will securities) had and you can kept because of the non.You.S. Citizens perhaps not domiciled in the united states make up assets inside All of us if your dominant borrower try a good “All of us people, or perhaps the United states, a state or one governmental subdivision thereof, or the Region of Columbia” (Sec. 2104(c)). You might only get involved in it the real deal money, thus registration in the 1xCasino and you will in initial deposit are a necessity.

FinCEN Finalizes Residential A home Reporting Conditions

A different relationship is people union (along with an organization categorized while the a collaboration) that is not arranged under the laws of any state from the usa or perhaps the Area from Columbia otherwise any partnership that’s managed while the international under the taxation laws and regulations. In the event the a different union is not a great withholding foreign relationship, the newest payees cash will be the people of one’s partnership, given the fresh lovers aren’t themselves disperse-as a result of entities or foreign intermediaries. But not, the fresh payee is the union itself if the relationship are claiming pact benefits on the base it is perhaps not addressed because the fiscally clear in the pact jurisdiction and this fits all of the additional conditions for stating treaty benefits.

+ equipment do book payments with your Repayments options yearly

If your overseas person matches their U.S. income tax accountability, you’re not responsible for the new tax but are still responsible for people attention and penalties for incapacity in order to keep back. Contact Rocket Home loan now and commence the loan app techniques. Various other crowdfunding systems offer varying traps in order to entry.

Home has a low and you will, sometimes, negative, correlation along with other major advantage kinds—definition, when stocks try https://vogueplay.com/ca/luxury-casino-review/ down, a property is often upwards. The new partners could possibly get found periodic distributions away from earnings produced by the new RELP’s functions, but the real rewards will come when the features are sold—that have chance, during the a sizable funds—plus the RELP dissolves later on. Like normal dividend-paying carries, REITs are appropriate to own traders who require typical money, even when they give the opportunity to own enjoy, too. A common technique is to help you charges sufficient lease to pay for expenses through to the home loan might have been paid off, at which time the majority of the lease becomes cash. The greatest downturn from the real estate market before the COVID-19 pandemic coincided on the Higher Credit crunch.

I value their contributions because the health care professionals, therefore we provide our very own Popular Financial Discounts to help you people in the fresh Light Coat Investor community. By this affinity system, we’re going to waive our financial and appraisal fees, taking a savings of up to $2198. Established in 1825, Liberty Bank is the eldest and you will premier separate common lender inside the country. All of our mission is always to improve the existence in our consumers, teammates, and you will communities to own generations to come. When you are our electronic devices alllow for a simple, simpler, and smooth techniques, the doctor Loan would be handled personally by the a region party out of credit pros always.

Probably the biggest cause a house traders branch on the industrial property are its possible to generate large productivity than just qualities. Lease are large for the industrial features, and you may larger buildings with more clients provide the capacity to scale up while increasing income. Rent terminology are also lengthier on the industrial features—generally 5 to ten years—you’re also often capable generate revenue a lot more consistently and you may deal with fewer return costs. To find home ETFs—usually when it comes to REITs—is a straightforward and you will sensible road to presenting their profile in order to the genuine property industry.

Being qualified Transactions must be finished in the leastthree (3) business days ahead of application becoming entitled to introduction within the deciding whether your metthe “Matchmaking Account” part of the “Financial which have Trick” conditions. The physician Loan System is perfect for doctors who are to find the Number one Residence. Training medical professionals need to be out of house/internship/fellowship less than 10 years.

How to initiate investing in a property is always to buy offers of an excellent REIT or a house finance. You can purchase started for only $10 sometimes (Fundrise have a great $ten minimal financing). You could potentially gradually invest more as you have more cash so you can dedicate to expand their a house profile.

Exactly what do You will want to Benefit Inside the Home?

- None the brand new transportation services exclusion nor the fresh around the world ideas exception enforce on the pay from a citizen out of Canada otherwise Mexico which is employed completely inside You and you may just who commutes from a property within the Canada or Mexico to be effective on the Joined Says.

- A different individual does not have to give a great You.S. otherwise foreign TIN so you can claim a lower rates of withholding less than a great pact for section step 3 intentions in case your standards on the pursuing the exclusions try fulfilled.

- Home assets may also make earnings of rents otherwise home loan money as well as the potential for investment progress.

- The buyer of the house tend to withhold and remit the real Estate Withholding currency so you can Maine Funds Features playing with setting REW-step one.

- Focus paid back to a controlled foreign firm of a person associated to your managed international firm isn’t profile desire.

Whether or not constantly found in the student blogs of your tax treaties, all these exemptions and connect with search gives gotten from the scientists who are not people. The newest pact supply constantly exempts the entire grant or fellowship count, regardless of whether the newest give try a good “licensed scholarship” under U.S. law. The newest payer of one’s offer otherwise grant need to remark the shape W-cuatro to make sure all of the required and you will needed info is considering. Should your withholding agent understands or have reasoning to find out that the fresh number revealed to the Mode W-4 can be incorrect, the brand new withholding representative need to refuse the design W-4 and withhold at the appropriate legal rate (14% otherwise 29%).

Its not necessary to determine the part cuatro condition from the connection since the fee is not a good withholdable fee. The desired withholding amount is still 2.5% of your complete conversion speed. Yet not, owner could possibly get consult one a lesser matter end up being withheld. Pursuing the federal assistance to own an installment sale, the vendor reports the amount of gain to be realized within the the entire year of one’s product sales. The newest Maine a house withholding amount is generally centered on it first-seasons obtain.

Buy services made because the a member of staff because of the an enthusiastic alien who is also the newest receiver of a grant or fellowship grant is always at the mercy of graduated withholding less than chapter step three depending on the legislation discussed later on within the Earnings Paid in order to Personnel— Graduated Withholding. Including nonexempt quantity someone who is an applicant to own a qualification receives for knowledge, undertaking look, and doing most other part-date work necessary as the a disorder for finding the newest grant otherwise fellowship give (which is, compensatory grant otherwise fellowship income). Dividend similar costs are treated while the U.S. origin dividends in a way that withholding lower than chapter step 3 get apply. Fool around with Earnings Code 34 otherwise 40 to help you report dividend equivalent costs.

Seeking purchase home however yes how to safer financing to possess multiple local rental characteristics? In 2010, the guy invested $165 million to find a couple flat complexes inside the Duluth, Georgia and you can Raleigh, Vermont, next expanding his residential a house holdings. There are many kind of commercial a home and industrial facilities, warehouses, shopping centers, workplace spaces, and you will scientific facilities.

We know regional lending that have workplaces within the more than 35 communities around the Minnesota and Wisconsin. We are committed to get together the information when you’re offering all available funding substitute for my personal users to aid get to the economic wants and desire home ownership. step 3 Dismiss available on traditional conforming money out of sales to possess number one houses only. Render readily available for the brand new primary mortgages and you will mortgages already dependent from the Liberty FCU when refinanced having at the very least $10,100000 the brand new money. Freedom FCU verifies the past checking history of individuals with ChexSystems, a national individual reporting network.

A keen NQI can be regarded as to own didn’t provide specific allotment suggestions if it cannot leave you including guidance for lots more than 10% of every one withholding rate pool. If the an enthusiastic NQI spends the opposite processes, it should provide you with withholding rates pool information, as opposed to private allowance information, before the fee from a reportable matter. The fresh NQI must provide your for the payee specific allotment information (information allocating per commission to every payee) from the January 29 pursuing the twelve months out of fee, but since the if you don’t enabled to own part cuatro objectives, while using this technique. To have chapter cuatro objectives, a You.S. individual doesn’t come with a different insurance carrier that has produced a keen election lower than point 953(d) in case it is a selected insurance carrier which can be maybe not signed up to do business in just about any county. Despite the newest foregoing, a withholding agent is always to get rid of such organization as the a good You.S. person to have purposes of documenting the newest organization’s condition to possess reason for chapters step 3 and you will cuatro. Investing commercial a home constantly demands big levels of financing than residential a house, but it could possibly offer high production.